Insights: eCommerce data and brand strategy

MikMak examined which data strategies are driving the most profit for brand partners, and discovered data patterns that can help you understand what your brand can do to increase sales.

Author’s note: it has been a pleasant journey with MikMak over the last twelve months. Though naturally, not all sales are attributed, however MikMak has helped me appreciate purchase intent, and how the platform has value beyond sales data.

eCommerce: First-Party Data

According to Sizmek data as reported by eMarketer, 85 percent of companies in the U.S. now say using first-party data is a high priority. That’s good news for most retailers, which have an abundance commerce data. However, in order to aim for the most profit out of first-party data, you’ll need to learn to use it strategically.

How to Use eCommerce Data to Grow Your Brands

MikMak examined what’s been working best for top brand partners. Here are a few of the takeaways to help you harness the potential of your eCommerce data.

Narrow Metrics and First-Party Data

The first step toward propelling eCommerce sales with data is focusing on the metrics that will drive the most profit. Example of a high-level view of a few types of performance metrics that top brands are tracking:

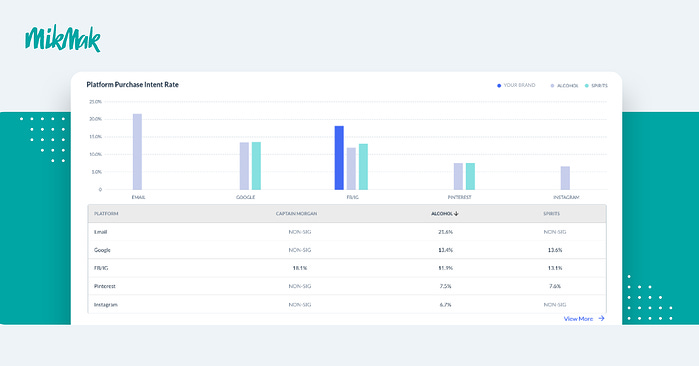

Platform metrics: These metrics measure how your campaigns are performing on different platforms, such as Instagram, Twitter, and YouTube. A few examples of platform metrics include cost per click (CPC), organic impressions, and paid impressions.

Sales and checkout metrics: These are figures that track how much consumers are spending during their shopping sessions. Some important sales and checkout metrics are average basket size, retailer views, and retailer preference.

Consumer insight metrics: Consumer insight metrics provide a deeper look at shoppers’ behaviors. A few insightful consumer metrics are percent of total sales by SKU, device type, and geolocation breakout.

Purchase Intent

Purchase intent rate (PIR) has stood out as a guiding metric for these enlightened companies.

A MikMak brand partner, Sabra, used PIRs to reposition their full marketing, placement, and packaging strategy—and their sales jumped by 15 percent. MikMak claims that some top brand teams avoided focus groups and brand lift studies and instead opted for real-time eCommerce data. For my client, we definitely are obtaining insight much earlier once we launch a campaign.

PIR plots the number of consumers who indicate their intentions to buy by clicking through at least one retailer.

Author’s note: I use PIR to see how consumers are interacting with different retailers, channels, and messages. With those insights, I can follow real-time behaviors and adjust for more sales.

Benchmark Insights

Benchmark insights are important to see how your brands compare to other names. MikMak Benchmark Insights compare brand performance across different retailers, location, marketing channels, platforms, and other shopping vehicles.

Those insights can reveal opportunities for brand teams to increase their ROI. For instance, one of MikMak’s healthcare brand partners recently started using Benchmark Insights to understand how it stacks up against its competition. It used those insights to reposition its brand on platforms where its competitors were seeing success, including Pinterest, Pandora, and Google. That strategy paid off when the brand saw Google’s PIR hit 16 percent—a figure almost three times higher than the industry average.

Inventory Awareness

According to a 2021 McKinsey report, 70 percent of shoppers will switch to a new brand when the product they want is out of stock.

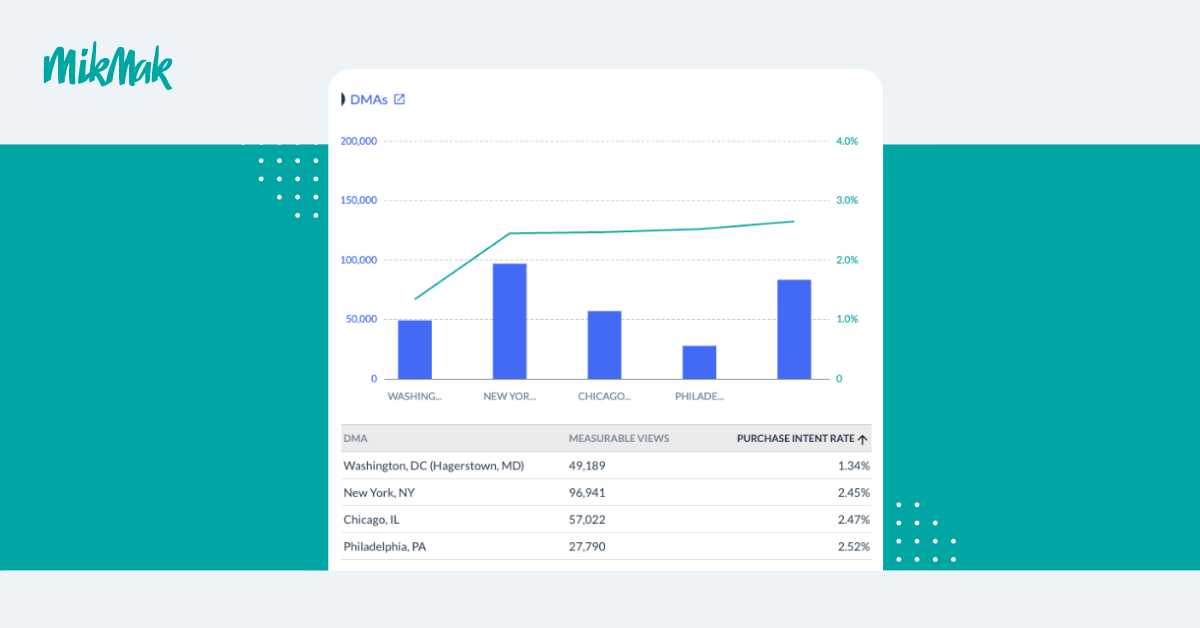

To avoid inventory-related losses, top brands are tracking measurable views and PIRs by region. From there, brand leaders pair that data with retailer preference data to see how much inventory they need in any given area.

In terms of in-market traffic, minor shifts were observed from last year’s mix. Facebook and Instagram still dominated the Purchase Intent Clicks in 2022. However, TikTok presented itself as a major player moving into the third spot.